Introduction to Personal Financial Planning

Personal financial planning is an essential process for anyone looking to manage their money effectively, aiming for personal economic satisfaction or financial freedom. This article delves deep into the intricacies of personal financial planning, from understanding the basics to dissecting its components.

This comprehensive guide through personal financial planning

Key Takeaways

Personal Financial Planning

Introduction to Personal Financial Planning

What is Personal Financial Planning?

Personal Financial Planning is the process of managing your money to achieve personal economic satisfaction. This strategic planning involves setting goals, analyzing financial status, and making informed decisions to enhance your financial health and secure a comfortable future.

Why is Personal Financial Planning Important?

- Achieves Financial Freedom: Effective management of finances leads to financial stability and independence.

- Secures Future: It helps in planning for retirement, emergencies, and unforeseen expenses.

Personal vs Corporate Financial Goals

Understanding the Differences

While both personal and corporate financial planning aim for optimal use of funds, their strategies, objectives, and impacts differ significantly.

- Personal Financial Goals focus on achieving individual or family financial security and dreams.

- Corporate Financial Goals aim at maximizing shareholder value and sustaining business growth.

Similarities between Personal vs Corporate Financial Goals

Despite their differences, both require careful planning, budgeting, and goal-setting to succeed.

The Financial Plan: A Roadmap to Financial Freedom

A financial plan is a comprehensive report detailing your current financial status, needs, and future activities. It’s your roadmap to financial freedom, guiding you through various stages of life and financial decisions.

Key Components of a Financial Plan

- Assess Your Current Financial Situation: Gather all financial statements and assess your current position.

- Set Financial Goals: Define short-term and long-term goals clearly.

- Develop a Strategy: Plan actions for achieving your financial goals.

Advantages of Financial Planning

- Increase Efficiency and Control

- Improves Personal Relationships

- Provides Freedom

Personal Value and Life Cycle

Understanding your life cycle and personal values is paramount in shaping your financial planning. Each stage of life brings about different financial needs and goals.

Adult Life Cycle and Financial Needs

- Young Adulthood (18–24 years): Focus on education, the start of the career, and financial independence.

- Early Adulthood (25–44 years): Marriage, home purchase, and child-rearing.

- Midlife (45–64 years): Higher earnings, savings for retirement, college education for children.

- Late Adulthood (65 years and over): Retirement, estate planning, and managing health costs.

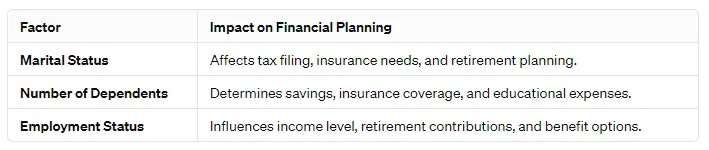

Life Situation Factors and Their Impact

Your life situation, including marital status, number of dependents, and employment, significantly influences your financial planning strategies.

Age, Marital Status, and Household Dynamics in Financial Planning

Your age, marital status, and the dynamics of your household play crucial roles in shaping your financial goals and strategies.

How Age Influences Financial Goals

- Young Adults: Building credit, saving for a home, starting retirement funds.

- Middle-aged Adults: Maximizing retirement savings, and college funds for children.

- Older Adults: Estate planning, wealth transfer, healthcare costs.

Marital Status and Financial Planning

Different stages of marital status necessitate different financial planning strategies:

| Marital Status | Financial Considerations |

|---|---|

| Single | Emergency funds, retirement savings, and personal investments |

| Married | Joint accounts, spousal retirement plans, and insurance policies |

| Divorced/Widowed | Adjusting beneficiaries, estate planning, and revising financial goals |

Employment Status and Financial Goals

Your employment status directly affects your income and, subsequently, your financial planning objectives and strategies.

| Employment Status | Financial Strategies |

|---|---|

| Full-time Employment | Maximizing employer benefits, retirement savings plans |

| Part-time Employment | Supplemental income strategies, budget adjustments |

| Self-Employed | Retirement planning, tax considerations, insurance needs |

Also Read: Are You Ready for Retirement?

Setting and Achieving Financial Goals

Identifying and prioritizing your financial goals is a cornerstone of personal financial planning.

Essential Financial Goals and Activities

- Career Training: Investing in yourself to increase your earning potential.

- Effective Financial Recordkeeping: Essential for tracking progress towards goals.

- Developing a Savings and Investment Program: Key for long-term financial security.

Financial Goals Table

| Goal | Strategy |

|---|---|

| Emergency Fund | Save 3–6 months’ worth of living expenses |

| Insurance Coverage | Obtain health, life, and property insurance |

| Flexible Budgeting | Adjust spending habits to align with financial goals |

| Retirement Planning | Contribute to retirement accounts and pension plans |

| Estate Planning | Create a will, designate beneficiaries and estate taxes |

Your employment status directly affects your income and, subsequently, your financial planning objectives and strategies.

Frequently Asked Questions (FAQs)

Essential Financial Goals and Activities

- Career Training: Investing in yourself to increase your earning potential.

- Effective Financial Recordkeeping: Essential for tracking progress towards goals.

- Developing a Savings and Investment Program: Key for long-term financial security.

Financial Goals Table

Your employment status directly affects your income and, subsequently, your financial planning objectives and strategies.

Final Thoughts -

This comprehensive guide through personal financial planning emphasizes the importance of understanding and integrating various components based on personal values, life cycle, and financial goals. With a solid plan and adaptive strategies, achieving financial freedom and security is within reach, ensuring a comfortable present and a secure future.