The equity market, often referred to as the equity market, presents rewarding but risky chances for wealth accumulation and investment. The best stock trading apps in India are those that are dependable and easy to use to successfully navigate the dynamic environment.

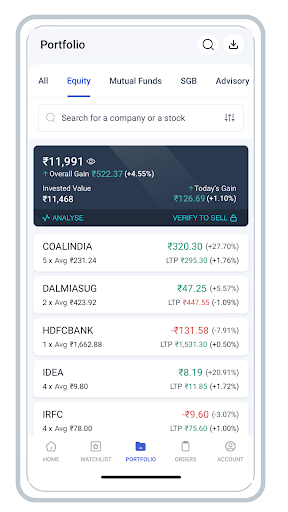

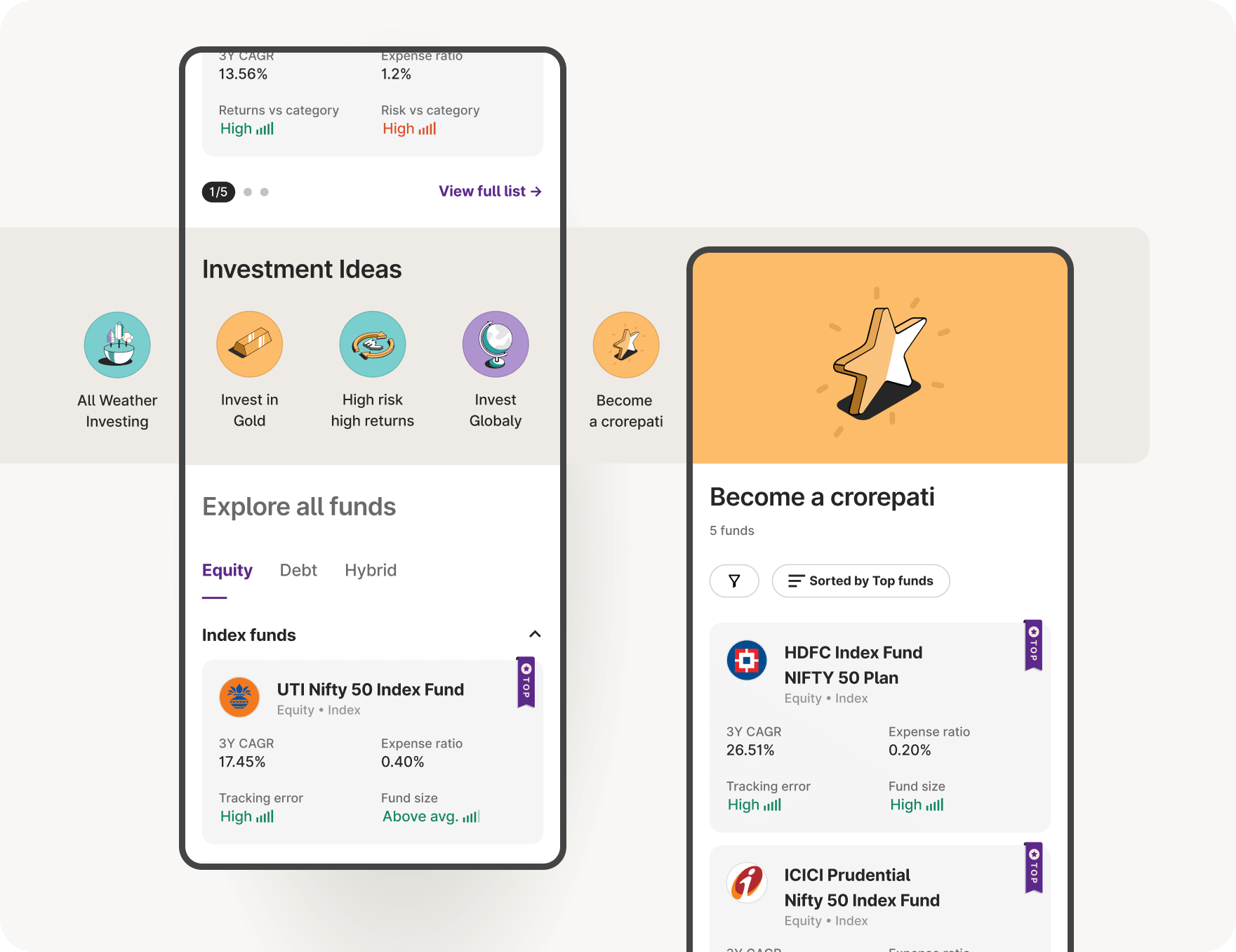

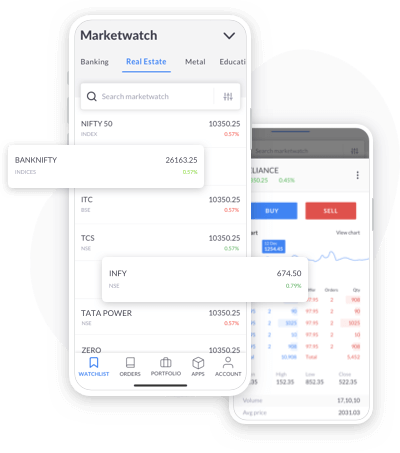

These trading apps, which provide users access to the market, let them execute trades, analyze data, and manage portfolios. Today they have evolved into essential tools for stock trading. The top ten stock trading apps in India are examined in this post, along with their features, advantages, and suitability for various investor types.

Features and Advantages of India’s Best Stock Trading Apps

Comparative Research & Analysis

Choosing the Right Stock Trading App for You

Quick Comparison of the Best Stock Trading Apps in India

| App Name | Best Known For | Trading Charges | Account Opening |

|---|---|---|---|

| Angel One | Trade monitoring features | Equity Delivery: Nil Equity Intraday: ₹20 or 0.25% (whichever is less) |

No charges |

| Groww | Ideal for beginners | 0.05% or ₹20 (whichever is lower) | No charges |

| 5paisa | Option for automatic investing | Equity Delivery: ₹20 Equity Intraday: ₹20 |

No charges |

| Upstox | Ideal for immediate investment | Equity Delivery: 2.5% or ₹20, whichever is less Equity Intraday: 0.05% or ₹20, whichever is less |

No charges |

| Kite by Zerodha | Overall Trading Experience | Equity Delivery: Nil Equity Intraday: ₹20 |

₹200 |

| ICICI Direct | Marginal trading and pay later | Equity Delivery: 0.55% Equity Intraday: ₹20 |

No charges |

| IIFL | Stock tips and research reports | Equity Delivery: ₹20 Equity Intraday: ₹20 |

No charges |

| Sharekhan | Research reports and access to IPOs | Equity Delivery: 0.30% on market rate or minimum 1 paisa per share Equity Intraday: 0.02% on market rate or minimum 1 paisa per share |

No charges |

| Motilal Oswal | Advanced tools and quick price alerts | Equity Delivery: ₹20 Equity Intraday: ₹20 |

No charges |

| Kotak Securities | Opening an account is easy and quick | Equity Delivery: Nil on higher plans; 0.25% on trade free plan. Equity Intraday: Nil |

No charges |

Also Read: Mutual Funds Hidden Charges

List of Top 10 Stock Trading Apps in India

(List updated on 27-03-2024)

We have ranked the apps based on their popularity and their ratings on the Google Play store.

Also Read: Mutual Funds Hidden Charges

Final Thoughts on the Best Stock Trading Apps in India -

The topic of which of the top stock trading apps is the best, is highly significant in the finance industry. Even for beginners, trading is made simple and convenient by the accessibility of these apps. These apps meet the wide range of needs of investors with their unique features and services.

It becomes clear as we delve deeper into the world of stock market trading apps that Gen Z and millennials have embraced these channels. The significant rise in demat accounts is evidence of these applications’ popularity, which is fueled by their attractive returns and straightforward account opening process.

It might be challenging to select the best trading platform because there are so many options accessible. Our in-depth analysis of some of the top stock trading apps attempts to help you along this road.

To discover more investment options in India, get in touch with us.