Top 10 Life Insurance Companies in India

India’s life insurance sector is one of the fastest-growing segments in the country’s financial market. With a growing middle class and an ever-increasing awareness of the importance of financial planning, the demand for life insurance in India has skyrocketed in recent years. As a result, several life insurance companies have emerged to cater to this growing demand. In this article, we will take a look at the top 10 life insurance companies in India.

When ranking the top 10 life insurance companies in India, several factors were taken into account. These factors include claim settlement ratio, solvency ratio, annual premiums, and customer reviews. The companies were evaluated based on these criteria to determine the top 10 life insurance companies in India.

In this article, we will provide an overview of the life insurance sector in India and the criteria used to rank the top companies. We will then take a closer look at each of the top 10 life insurance companies in India, including Max Life Insurance, LIC of India, HDFC Life Insurance, ICICI Prudential Life Insurance, SBI Life Insurance, Bajaj Allianz Life Insurance, Reliance Nippon Life Insurance, Kotak Mahindra Life Insurance, and Tata AIA Life Insurance.

Key Takeaways

Overview of Life Insurance in India

Life insurance is a contract between the policyholder and the insurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured person. In India, life insurance is a highly regulated industry, overseen by the Insurance Regulatory and Development Authority of India (IRDAI).

There are two types of life insurance policies in India – term insurance and endowment policies. Term insurance policies provide coverage for a specified term, while endowment policies provide both insurance coverage and savings.

The life insurance industry in India has seen significant growth in recent years, with over 24 IRDAI-registered insurance companies offering life insurance plans. According to PolicyX, the life insurance sector in India is expected to grow at a CAGR of 12-15% over the next five years.

The top 10 life insurance companies in India, as per Ditto are Max Life Insurance Company, Life Insurance Corporation of India, HDFC Standard Life Insurance Company, SBI Life Insurance Company, ICICI Prudential Life Insurance Company, Bajaj Allianz Life Insurance Company, Kotak Mahindra Life Insurance Company, Tata AIA Life Insurance Company, Aditya Birla Sun Life Insurance Company, and PNB MetLife India Insurance Company. These companies offer a range of life insurance plans to cater to the diverse needs of customers.

Criteria for Ranking the Top 10 Life Insurance Companies

When ranking the top life insurance companies in India, several factors were taken into consideration. These factors include the claim settlement ratio, customer service, product portfolio, and market share.

Claim Settlement Ratio

The claim settlement ratio refers to the percentage of claims that an insurance company has settled against the total number of claims received. A high claim settlement ratio indicates that the company is reliable and can be trusted to pay out claims promptly. For this reason, it was a significant factor in determining the top life insurance companies in India.

Customer Service

Providing excellent customer service is crucial for any business, including insurance companies. A company that offers prompt and efficient customer service can help customers resolve issues quickly and efficiently. Therefore, customer service was also considered when ranking the top life insurance companies in India.

Product Portfolio

The product portfolio of an insurance company includes the variety of policies that it offers to its customers. A company with a diverse range of policies can cater to the different needs of its customers. The top life insurance companies in India were evaluated based on the range of policies they offer, including term plans, whole life plans, endowment plans, and ULIPs.

Market Share

The market share of an insurance company refers to the percentage of the total insurance market that it occupies. A company with a significant market share is likely to have a strong financial position and be well-established in the industry. Therefore, market share was also a factor considered when ranking the top life insurance companies in India.

Overall, the top life insurance companies in India were evaluated based on their financial strength, reputation, and customer satisfaction. These factors were used to determine which companies offer the best value to their customers and are most likely to provide reliable coverage in the event of a claim.

Quick Comparison of the Top 10 Life Insurance Companies in India

| App Name | Best Known For | Claim Settlement Ratio | Market Share |

|---|---|---|---|

| LIC of India | Government-Owned Insurance Group | 98.50% | 58.50% |

| Max Life Insurance | Highest Claim Settlement Ratio | 99.65% | 6.20% |

| HDFC Life Insurance | Strong Digital Platform | 99.50% | 6.10% |

| ICICI Prudential Life Insurance | Customer-Centricity | 97.90% | 4.01% |

| SBI Life Insurance | State Government-Owned | 93.09% | 7.01% |

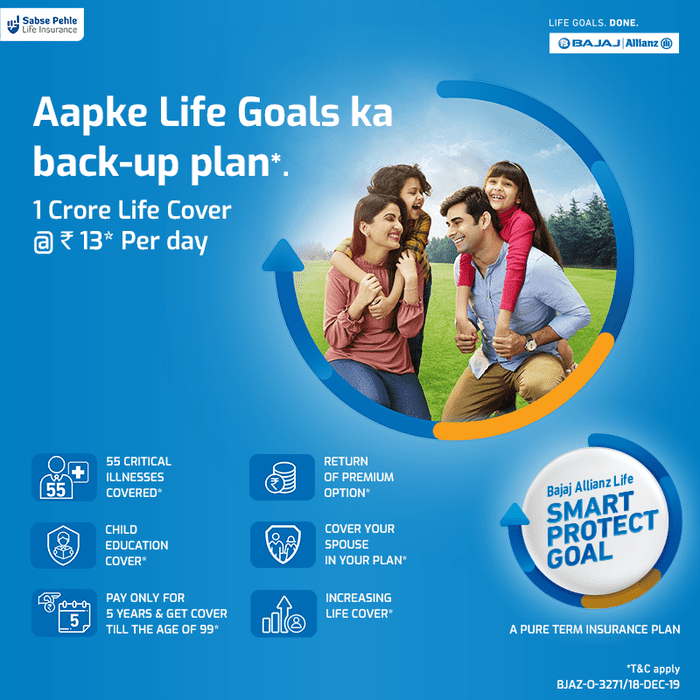

| Bajaj Allianz Life Insurance | Variery of Insurance Provided | 98.48% | N.A. |

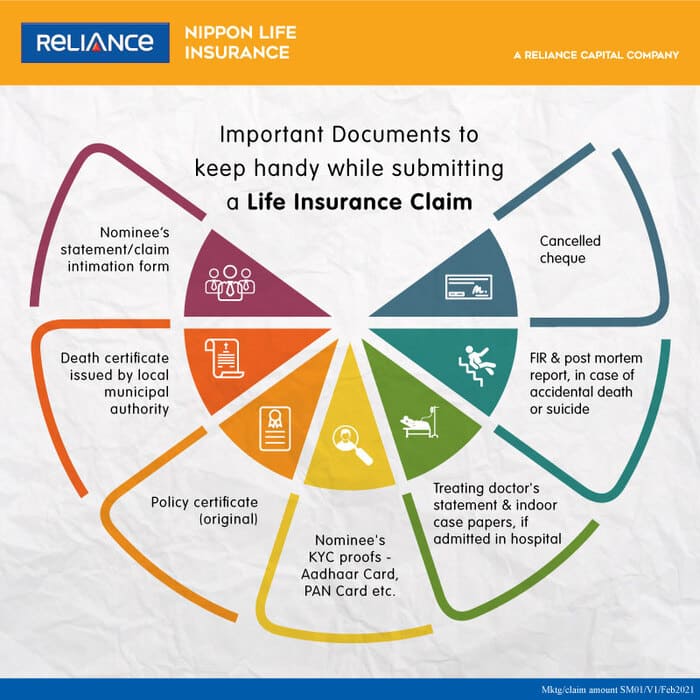

| Reliance Nippon Life Insurance | – | 98.49% | N.A. |

| Kotak Mahindra Life Insurance | – | 98.50% | N.A. |

| Tata AIA Life Insurance | Brand Image | 98.02% | N.A. |

| Bharti AXA Life Insurance | – | 99.05% | N.A. |

List of Top 10 Life Insurance Companies in India

(List updated on 26-06-2024)

We have ranked the top 10 life insurance companies in India based on their Claim Settlement Ratio, Customer Service, Product Portfolio and Market Share, in that order.