With the US dollar decline, mostly in the fourth quarter of 2023, it is on the verge of its most challenging year since the pandemic’s emergence, with Wall Street foreseeing a potential decline due to the Federal Reserve’s likely decision to reduce interest rates after effectively managing inflation.

Steady US Dollar Decline

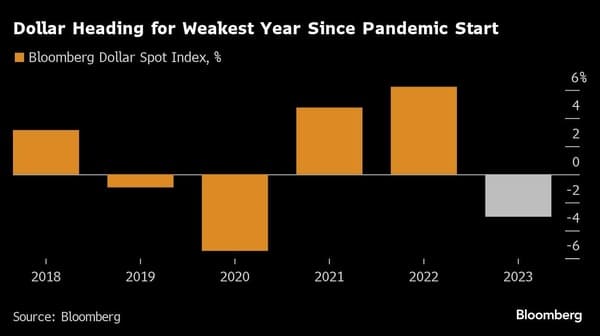

Following oscillations caused by premature predictions signalling the conclusion of the Fed’s rate hike policies, a Bloomberg index reflecting the dollar’s strength has declined by almost 3% since January, marking the most significant annual dip for the currency since 2020.

Most of the US dollar decline transpired in the fourth quarter, fueled by growing speculations that the Fed will significantly ease its policies next year in response to a slowdown in the US economy. This diminishes the attractiveness of the dollar compared to currencies of other nations whose central banks may maintain higher rates for an extended period.

Traders in the swaps market are currently factoring in anticipated Fed rate cuts of at least 150 basis points, with the initial cut possibly as early as March. This projection has risen from below 100 basis points in mid-November and doubled what policymakers had initially estimated in their recent meeting. Concurrently, speculative traders have adopted a more pessimistic stance towards the dollar following the Fed’s December meeting.

Goldilocks Scenario

Amanda Sundstrom, a fixed income and FX strategist at SEB AB in Stockholm, remarked, “Markets are aligning for this ‘Goldilocks’ scenario where the Fed will reduce rates sufficiently to stimulate the economy without triggering inflationary pressures. This sentiment is driving the dollar’s performance.”

Sundstrom added that the US dollar’s declining or softening is likely to persist in 2024 as US economic data weakens, although not enough to evoke a rush for safe-haven assets like the greenback.

Despite recent substantial losses, there seems to be room for at least a temporary rebound. The Bloomberg Dollar Spot Index’s 14-day relative strength recently dropped below 30, indicating to some analysts that the greenback is currently “oversold” and potentially positioned for a reversal.

On a recent Thursday, Bloomberg’s dollar gauge saw a slight uptick, breaking a four-session decline streak as global bonds retraced previous gains. However, the yen and franc continued to gain ground against the dollar, rallying over 1% intraday amid thin year-end trading.

Diverging Rates

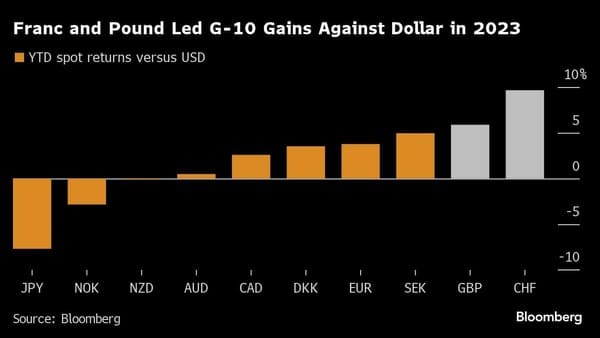

The dollar’s decline contrasts with the pound’s performance, which is on track for its most robust year since 2017, and the franc, set for its strongest annual performance since 2010.

In 2023, the sterling surged over 5% against the dollar, marking its best run since the currency’s tumultuous period during a series of Brexit votes six years ago. Meanwhile, the Swiss franc has surged to trade-weighted highs, with traders increasingly perceiving the Swiss National Bank as maintaining a comparatively tighter policy stance relative to other central banks, even after a relatively dovish SNB meeting on Dec. 14.

Geoffrey Yu, a currency and macro strategist at BNY Mellon in London, commented, “If I had to identify a central bank most likely to intervene to devalue their currency next year, it would be the SNB.” Regarding the pound, he added, “I won’t aggressively pursue it until we have more clarity from the BOE.”

Decline in Dominance of US Dollar

Following its surge to a two-decade peak fueled by the Fed’s rate hikes in 2022, the US currency has mostly remained within a defined range this year, buoyed by robust US growth and the central bank’s commitment to maintaining elevated borrowing costs.

Accurately predicting the dollar’s trajectory is crucial for analysts and investors due to its pivotal role in global finance.

For the US, a weakened or declining US dollar would enhance export competitiveness abroad and bolster multinationals’ profits by reducing the cost of converting their foreign earnings into dollars. According to FactSet data, approximately a quarter of S&P 500 companies generate over 50% of their revenues outside the US.

A Reuters poll in early December involving 71 FX strategists indicated expectations for the dollar’s decline against G10 currencies in 2024, with a substantial portion of this decline anticipated in the latter half of the year.

Final Thoughts

The dynamics influencing the US dollar’s trajectory are complex and interconnected with global economic shifts. As we anticipate the potential trends in 2024, the Federal Reserve’s policy decisions, economic data, and the response of other central banks will play crucial roles in shaping the currency’s performance.

A declining US dollar might have varied implications, impacting exports, multinational corporations, and international trade dynamics. This can create both challenges and opportunities across different sectors and markets.

Keeping an eye on these developments and staying informed about evolving economic indicators could offer insights for making informed decisions, especially in the realm of international trade, investments, and financial planning.

References:

- https://www.bloomberg.com/news/articles/2023-12-28/dollar-battered-by-rate-cut-bets-set-for-worst-year-since-2020

- https://www.livemint.com/economy/end-of-dominance-us-dollar-to-keep-falling-against-g10-currencies-in-2024-11703897172707.html