Personal Financial Planning: Comprehensive Guide

This comprehensive guide through personal financial planning emphasizes the importance of understanding and integrating various components based on personal values, life cycle, and financial goals.

TCS on Fund Transfers to NRIs

There is a confusion on whether to pay a 20% TCS on fund transfers to NRIs on either on their NRE, Foreign Account or NRO Bank Account. We clarify.

Stock Trading Apps in India 2024 – 10 Best Trading Apps

Stock trading apps make trading is made simple and convenient. We have researched and listed the top ten stock trading apps of 2024 in India, along with their features, advantages, and suitability for various investor types.

NRI Investment Opportunities in India FY 2024-25

Wide range of NRI investment opportunities in India are available. NRIs may make wise investments in India and reap the rewards of long-term wealth growth with proper preparation and study. There are plenty of options in India to invest your money in, but the right way to select the best investment option to achieve your financial goal(s) is by considering it’s returns on investment (high, medium and low), investment term (long, medium, short) and risk property (high, medium and low).

Should NRE deposits be reported in IT Returns?

It's suggested that the interest exemption under the IT Act may apply only while the individual is a PROI or permitted to maintain the account as per FEMA, once they return to India for employment and become a PRII.

Optimise International Retirement Investment Options

Strategic cross-border investments and exploring international retirement plans can significantly enhance the diversification of your portfolio while potentially bolstering your retirement funds. Here's a comprehensive guide to optimising international retirement investment options and navigating this path effectively.

Gold Prices in 2024 Expected to Touch ₹70,000

Potential surge of gold prices in 2024 to ₹70,000 per 10 grams. Rise in gold prices in 2024 hinges on factors like the dollar index, global economic conditions, and geopolitical stability. Gold retains its allure as a safe-haven asset and a hedge against inflation, setting the stage for an intriguing year ahead in the bullion markets.

India’s Forex Reserves Rebound as RBI Adds $58 Billion This Fiscal Year

In a remarkable resurgence, foreign exchange reserves of India have surged by $4 billion, reaching an impressive $620 billion as of December 22, 2023, as per recent data released by the Reserve Bank of India (RBI). This fiscal year has seen a substantial addition of $57.59 billion to the country's forex reserves, illustrating India's resilience in bolstering its financial stability.

Further US Dollar Decline in 2024 Anticipated

With the US dollar decline, it is on the verge of its most challenging year since 2020 and likely to persist in 2024 as US economic data weakens.

Mutual Funds Hidden Charges

Mutual fund hidden charges will not only eat into your capital gains, but they may also reduce your investment principle. Make sure you understand all the hidden charges of mutual funds beforehand.

Personal Wealth Erosion – The Silent Thief

Wealth erosion is a silent but relentless force that can chip away at our financial security. With prudent planning and strategic investments, wealth erosion can be effectively curtailed, allowing your financial fortress to withstand the test of time.

What Are Some Best Ways to Invest Money in India?

In the pursuit of financial success, maintaining a strategic, diversified investment approach in India is paramount. Embrace the power of long-term thinking, diversification across asset classes, and a keen understanding of risk to navigate the ever-changing landscape of financial markets.

Buying Gold Coins from Banks: Pitfalls and Challenges

While the appeal of physical Gold Coins from banks may seem compelling, hidden pitfalls often overshadow their glitter. Higher costs, limited liquidity, and the absence of a buyback assurance can trap investors in a cycle of uncertainty.

Could You do Investments for Your NRI Son?

As a power of attorney holder, you're authorised to handle the sale of immovable properties for your NRI son, given that the power of attorney is explicitly designated for those specific properties.

NRI Week in January 2024 to Foster Investments & Address Concerns

The proposed NRI week in January not only signals the Indian governments commitment to engaging with the Indian diaspora but also underscores the growing confidence in India's financial landscape. The dedicated NRI week in January, coinciding with the highly anticipated Pravasi Bharatiya Divas in January 2024.

Opening an NRI Bank Account – Complete Guide

Opening an NRI bank account is a pivotal step for NRIs to manage their finances, investments, and remittances efficiently. Understanding the types of accounts available and following the outlined step-by-step process can streamline this essential financial undertaking, ensuring a secure and convenient banking experience for NRIs.

Understanding NRI Banking and Accounts

For Non-Resident Indians (NRIs), managing finances back home or making investments in India demands a tailored approach. It's crucial to...

Free Look Period in Insurance: Your Upper Hand

The Free Look Period is a valuable tool that empowers policyholders to ensure they have chosen the right insurance policy. It grants them the time to assess the policy document thoroughly consider and decide whether to cancel or keep the policy after the Free Look Period.

Human Life Value – Foundation for Financial Planning

Understanding your Human Life Value is the first step towards comprehensive financial planning. It offers a clearer perspective on how your financial decisions impact not just your life but the lives of your loved ones.

Reinvestment Risk After Retirement – Problems & Solutions

Retirement is a time to enjoy life, not to fret about the safety of your savings. #Reinvestmentrisk is a genuine concern for retirees, but with guaranteed fixed returns through certain insurance policies and annuity products, you can secure your financial future. The case studies presented here illustrate how these solutions can make a significant difference in retirees' lives. It's time to enjoy your retirement with confidence and peace of mind, knowing that your financial security is well-protected.

ULIP Fund Switching Guide

Switching funds in Unit Linked Insurance Plans (ULIPs) is a crucial aspect of self-managing your ULIP investment portfolio. SimplePath tells you when and how you can switch funds to maximise your gains.

Wisdom for Secure Retirement

Retirement is a stage of life that demands careful financial planning and decision-making. Whether you are aiming to create a secure retirement with smart financial choices or simply seeking guidance on managing your finances, remember that your decisions today can shape the retirement you desire tomorrow.

ULIP Taxation and Tax Benefits

ULIPs are designed for the long term, and they offer tax benefits primarily for those who stay invested until maturity. Taxation plays a significant role in understanding the overall benefits and implications of investing in a Unit Linked Insurance Plan (ULIP).

Using ULIP as Effective Systematic Investment Plan

Using ULIPs as a Systematic Investment Plan offers a compelling blend of wealth creation and insurance coverage. The ability to systematically invest, combined with the potential for market-linked returns and tax benefits, makes ULIPs a viable option for those seeking long-term financial growth.

Financial Freedom: A Proven Path to All the Money You Will Ever Need

We will delve into the key principles and insights presented in Grant Sabatier's best selling book “Financial Freedom: A Proven Path to All the Money You Will Ever Need” and explore how it can empower readers to unlock the doors to financial abundance.

Tax-Free Income Planning by Leveraging 10(10D) Provision

The Income Tax Act is designed to ensure fair taxation and revenue generation for governments. However, within its provisions 'lies...

Are You Ready for Retirement?

Thinking about retiring? It’s important to envision, in detail, what you imagine your life to look like during retirement...

Fixed Passive Income for Securing Your Future

In today's fast-paced world, financial stability is a top priority for individuals, especially for the working Indian audience between the ages of 30 and 50. While a regular job provides a steady income, relying solely on it may not be sufficient to secure your future. This is where fixed passive income comes into play.

Essential Financial Tips for the Young Generation

We delve into the valuable financial tips and advice that a father imparts to his son, who has recently started working. These nuggets of wisdom, tailored for the Indian audience aged between 25 to 35, provide essential guidance on budgeting, debt management, savings, insurance, credit, investments, and more.

Seeds for Financial Growth

By sowing the seeds of financial growth early on, you can nurture them to grow into a garden of opportunities that will enable you to achieve your dreams and aspirations. In this article, we will explore how planning your finances can create a fertile ground for success.

Joint Bank Account with Spouse – Should You or Shouldn’t You?

Opening a joint bank account in India has its advantages and disadvantages. Discussing expectations, setting clear guidelines, and regularly reviewing the arrangement can help couples navigate the pros and cons effectively.

Home Loan With Overdraft Facility: All You Need To Know

Everything you wanted to know about Home Loan with Overdraft Facility such as what it is, how it works, its advantages and disadvantages, differences with regular home loan and if you should opt for it.

Fixed Annuities Comprehensive Guide: Securing Retirement Income

Fixed annuities can be valuable tools in retirement planning, providing a secure income stream, capital preservation, and tax advantages. By understanding the features, benefits, and considerations associated with fixed annuities, individuals can make well-informed decisions to enhance their financial security during retirement. It is essential to evaluate personal circumstances, consult with professionals, and continuously review financial plans to ensure a comfortable and prosperous retirement.

Retirement Planning for High-Income Professionals

Retirement planning for high-income professionals requires a holistic approach to secure a financially stable future. By integrating health and life insurance, low-risk saving plans, fixed annuities, and diversified investments, you can build a strong foundation for retirement.

Fixed Income Investments for Income Diversification in Retirement

When it comes to retirement planning, income diversification is key to financial security. Integrating fixed income investments into your portfolio offers reliable income, capital preservation, risk mitigation, and portfolio balance. Don't overlook the importance of fixed income in your retirement strategy.

Uncertainty Planning in Your Investment Strategy

Discover the power of uncertainty planning integrated into your investment strategy. Learn how embracing solutions for hospitalization, critical illness, accidents, and loss of income can secure your financial future. Simple Path offers personalized guidance to help you navigate life's uncertainties and achieve your financial goals.

The Ultimate Solution for Education Funds and Retirement Income

Discover why Smart Wealth Advantage Guarantee considered one of the best choices in India for creating an education fund for your children and ensuring a steady stream of income during retirement.

Financial Planning for Good Living

While it is essential to enjoy your active life and indulge in various experiences, it is equally crucial to plan for the future, especially during times when earning becomes challenging. By prioritising financial planning, you can build a secure environment and ensure a good quality of life for yourself and your family.

The Role of Life Insurance in Your Financial Planning

Integrating life insurance into your financial planning is a crucial step towards safeguarding your family's future. By understanding the stages of financial planning, recognizing the benefits of life insurance, and exploring the top life insurance companies in India, you can make informed decisions about protecting your financial well-being.

Protecting Your Income: Income Protection Importance & Strategies

According to financial expert Suze Orman, "The foundation of financial well-being is the protection of your income." Income protection helps you cover your living expenses, pay off debts, and maintain your standard of living in the event of an unexpected loss of income. It provides a safety net that can help you weather financial challenges and avoid falling into debt.

Simplify Financial Planning: A Guide to Achieving Financial Security

By adopting a simplified approach and seeking guidance from prominent financial experts, we can pave a clear path towards achieving our financial security. In this article, we'll explore essential steps and insights from renowned financial experts to help simplify your financial planning journey.

How Much Should You Save for Your Child’s Education Fund?

Planning for your child's education fund in India requires careful consideration and strategic planning. The earlier you start saving, the better, and you must factor in inflation to ensure that you have enough to cover future education costs.

Financial Disaster? Look at Your Home First

Your home is likely one of the most significant investments you will make in your lifetime. It can also be a major drain on your finances if you are not careful. Here are some ways that your home can contribute to a financial disaster and what you can do to prevent it.

Insurance Claims: What Your Nominee Needs To Do To File One

It is important to remember that while the process of filing an insurance claim may seem overwhelming, there are professionals like Donald Gonsalves and insurance companies like Max Life that are there to help.

Financial Mistakes That Can Be Avoided

In this blog post, we will be taking a look at some of the most common financial mistakes people make, and the lessons we can learn from them. We will be sharing real-life stories from individuals who have made these mistakes, and how they were able to recover and get back on track.

Niva Bupa ReAssure 2.0 – Most Suitable Health Insurance

Niva Bupa's Reassure 2.0 is a new health insurance plan that offers some unique features that make it an excellent option for people below 50 years of age. One of the most attractive features of this plan is that the premium is based on the entry age, and it remains the same until the policyholder makes a claim. This means that a young and healthy person can buy this plan and pay the same premium for many years until he/she makes a claim.

Teaching Financial Literacy to Children and Teenagers

Growing up, most of us were not taught how to manage money or handle financial matters effectively. We learned through...

Building an Emergency Fund: Why It’s Important and How to Do It

Rahul had always been a responsible person when it came to managing his finances. He had a well-paying job, and...

The Benefits of Tracking Your Spending Habits and How to Do It

Do you know where your money goes every month? Tracking your spending habits is one of the most effective ways...

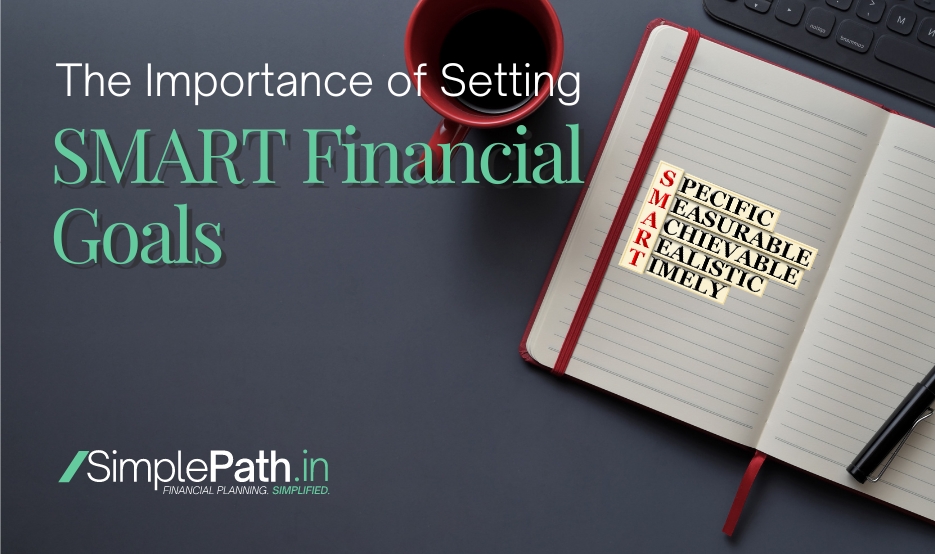

The Importance of Setting SMART Financial Goals

Setting SMART financial goals is essential for achieving financial success. By using the SMART framework, you can set clear and achievable objectives, track progress, and make informed financial decisions.

Top Ten Money Wasters & How To Stop Buying Them

There are many common money wasters that we all fall prey to, and with a little bit of awareness and self-discipline, we can stop buying them and save ourselves a lot of cash in the long run. In this article, we’ll take a look at the top ten money wasters and how to avoid them.

Buying A Home: Top Mortgage Tips

Buying a home can be an exciting and overwhelming experience. With so many options available, it can be challenging to know where to start. To help you navigate the mortgage process, we’ve put together some top mortgage tips.

Getting Started Reducing Your Debt

Getting started on reducing your debt can be overwhelming, but it is an essential step towards achieving financial freedom. In this article, we'll discuss some actionable tips and tricks to help you get started on reducing your debt.

How To Manage Your Wealth & Investments

Managing your wealth and investments requires careful planning, diversification, and regular monitoring. In this article, we will explore some key steps you can take to manage your wealth and investments effectively.

Investing In The Long Term

Investing in the long term is a strategy that has proven to be highly effective for wealth creation, especially when compared to short-term trading or market timing strategies.

The First Financial Change You Should Make

Making the first financial change is a crucial step towards achieving financial security and stability. In this article, we'll discuss the first financial change you should make to get your finances on track.